Take a Step!

If you are reading this, I hope it's because you want to take a step toward taking control over your finances. Most people are stressed by their budgets. Why? Why is it such a hassle to take the time to create a financial snapshot? Why do we dread crunching the numbers? I think it's because we are reminded of what we don't have. You've seen my budget...I'm not working with very much after my bills are paid and allotments are made for essentials. Knowing what you're working with will work for you!

We all have to do it! If you didn't plan or even have an idea of exactly how much you have, you would really be flying by the seat of your pants (or rather, your pockets). You would end up over-spending in several areas and not having enough money for the things you need (including emergencies). Perhaps the first time you sit down to analyze your spending will take you an hour, but if you make it a regular habit to revisit your budget, you'll find you have more time to enjoy doing other things.

Why would you want to take advice from me? Why wouldn't you?! I'm sure people would be pretty hesitant to listen to financial advice from a person who is on welfare. There is a stigma about those depending on government assistance as they are tagged as being unwise or just freeloading. While I cannot speak for everyone, I can simply ask that you read on. Perhaps there will be some information you haven't thought about, or maybe reiteration/reminder of what you've already learned. It helps to get information from different sources, so that you can mix and match based on what you need or what's easiest for you.

Track Your Income & Expenses

I have stated before that I like Crown Financial Ministries for their worksheets. You can actually download them for

free. They have this envelope budgeting thingy that helps you to allot money to specific needs. I'll talk a bit about that later. Even googling "financial worksheets" would bring up a slew of resources (what would I do without Google?).

First things first, you'll need a list of all your sources of income and all your expenses. Try to break everything down monthly. If you get paid bi-weekly or if you pay a bill every six months, be sure to break down what that will turn out to be every month. Once you have done that, you'll see what you have to work with. Remember

My Budget post?

Next, subtract an estimate of how much you will need of that leftover money for things like food, gas, etc. These would be the things you have to spend for on a regular basis, but don't have an exact total. One of my favorite worksheets to use is the

Income Allocation Sheet.

You can break down every pay period per month and get a good idea of how much you are working with at the beginning and the end of the month. This gives way to finding out how much you'll need to set aside every pay period specifically for all of the expenses you already know about. Remember, if you have expenses that you pay yearly or every 6 months, break them down to what they would be monthly and include them. It's not a bad idea (if you would like) to round up to the nearest dollar if you have cents in your amounts (just don't round down). When you get to that point in time where you have to pay that lump sum again, you'll already have it all saved up for that day.

I like to use a blank calendar and fill in what's due, when, and how much. This gives me a chance to see my daily or weekly break-down, as I'm a very visual person. It's easier for me to see that on 6/22/11 I need to transfer $320 to my bill paying account. If you would like to use a blank calendar, you can google "blank calendar" and pick one that suits your style. I used

timeanddate.com and printed one out. There is also your computer office software, calendars associated with your email account (I like Google calendar), or even within your email client (Microsoft Outlook, Mozilla Thunderbird). The dollar store sells little pocket calendars for (as you can guess) a dollar!

I also like to keep a list of my expenses (sorted by date due). On this list, there is also a total of how much to set aside per pay period for my bills. If you have a wall calendar or a fridge calendar in your home, don't be shy about writing your bills on their designated due dates (especially if you don't have automatic payments set up).

My list is usually updated every pay period (bi-weekly for me)...just to make sure I've got things where I need them to be.

If writing things down by hand is not appealing to you, you can always use financial planning/budgeting software.

Quicken

has been around for so long. It's tried and true, but paid financial software companies will usually encourage you to upgrade to the newest version. Before buying an older version, keep in mind that perhaps there will be no support or bank account synchronization available. You don't have to pay an arm and a leg for software. If you're like me, you'll try not to pay retail price. You can find financial freeware through sites like download.com, or you can use simple spreadsheet software.

Openoffice.org has a free download of office software (comparable to Microsoft Office). There are even online planners that can sync with your bank accounts to give you up-to-the-minute totals. I've used

Mint.com in the past. It's free, there is even a mobile application for your smartphone or iPod touch.

Some banks (if you have online banking) will allow you to link your accounts to all your financial institutions. This is helpful so that you don't have to open multiple web pages to view all of your balances. There may even be a free mobile application. Bank of America and USAA each have one.

Debt

Most people today have some form of debt. When considering paying back your debt (and you really shouldn't just consider it, but actually do it), there are few things to keep in mind. Always remember to include these obligations in your monthly expenses when you do your budgeting.

It's absolutely necessary to have a plan to pay off your debt. Whether it will take you 5 months or 10 years, make sure that you have a plan to pay it off for good. Lenders may even work with you to create the best repayment plan for you. I have USAA and have access to financial advisors at any time. Use your resources. Find out if your financial institution has someone you can talk to about managing your debt. If you have to pay for it, check to see if you can actually afford it, or simply look elsewhere. This country is in massive debt as a whole. Wouldn't it be nice to not be in the same boat as an individual?

Allocations and Accounts

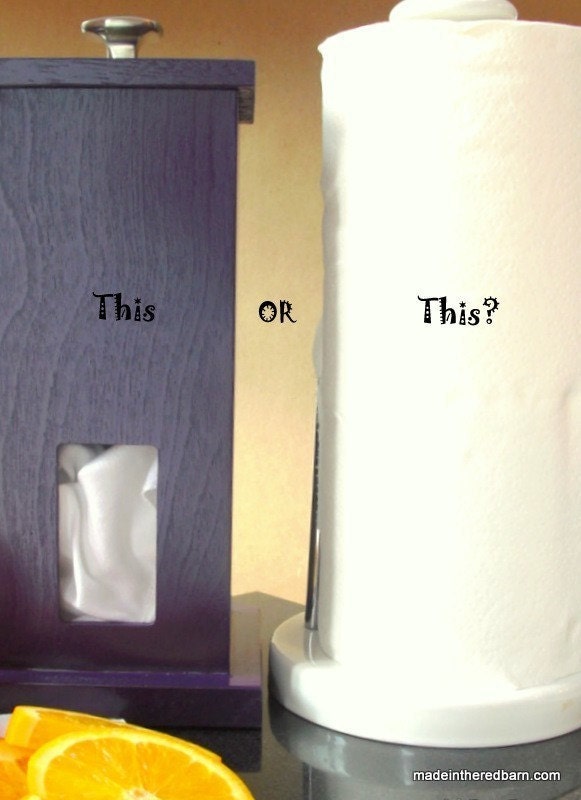

I had mentioned Crown's envelope budgeting system. When you understand how much to set aside from each pay period for your bills, you can break it down even further into categories. Each envelope would represent an expense category. The money for that category would go into that particular envelope and once it runs out, you are not to spend anymore (not even from another category). This is a great way to allot money for vacation, children's allowance, or the occasional night out. If you don't usually carry cash, and would rather use your check card, you can use the

Individual Account Page to set aside money. You would want to have one for each category, and when you allot money to the category, you would put it in your checkbook ledger. Say you allot $40 weekly for your groceries...

You would subtract the amount from your checkbook ledger...

..then add it to your Grocery Account Page. Whenever you spend money on groceries, subtract it from your Grocery account page (NOT from the checkbook ledger).

This is a very easy way to make sure you don't go over budget with things like groceries, clothing, housewares, etc (basically, those expenses that you spend on regularly, but are not exact like bills). Even if you receive foodstamps, it's pretty easy to budget. You already know how much you're receiving and when you'll receive it. Just keep a running tab of what you're spending, so that you don't go over.

I have a separate account for paying my bills. Every pay period, I transfer my allotment to my bills to that account. Only bills get paid with the bill paying account. You could have multiple checking accounts for your specific needs. I wouldn't advise you get 10 different accounts. I would say perhaps no more than 3 or 4, as there are also sometimes maintenance fees. No matter what, try to keep things at a minimum, but you need to have everything accounted for. You don't want to have too many things going on. The less you have to keep up with, the easier it is to stay organized.

Organize!

Perhaps the most important thing with any kind of planning is organization. Keep your financial planning tools together. Use a notebook for all your worksheets. Keep one computer file for all your virtual financial documents. Be sure that you know where your checkbook is and use it regularly to keep it up-to-date. Don't hesitate to review your documents to be sure you have everything in the right place and remove things that don't belong there.

Image: jscreationzs / FreeDigitalPhotos.net

These steps will give you a good picture of where you are currently. It's always surprising to see that, even when it doesn't feel like it, you can make a budget work. I had a friend who commented on how little I made (I made even less money then), but how much I've been able to do for my family. Don't ever think that you don't make enough or you make too much to budget. We all need a plan. There are other tools that will help you with where you want to be, but we will touch on those another day. I think I could go on about all the things you can use and do to for your finances.

Here is a list of books and things that I've used:

Young Couple's Guide to Financial Planning How to Manage Your Money

How to Manage Your Money Financial Planning Workbook

Financial Planning Workbook Crown Financial Ministries

Mint.com

Quicken Financial Software

Crown Financial Ministries

Mint.com

Quicken Financial Software timeanddate.com online calendar

OpenOffice.org Software

Microsoft Office

timeanddate.com online calendar

OpenOffice.org Software

Microsoft Office (there are even templates you can download for free, based on what version you have).

Microsoft Works

Microsoft Money (if you're familiar with MS Money, then you know that it doesn't exist anymore, but Bundle is available online, free to use. I have not tried Bundle.com)

Incomeptech.com has different kinds of pre-made paper to download, if you would like to write things down. I love to use the cornell lined paper for notes.

HAPPY PLANNING!